Trump and the Fed

That is the topic of my latest Bloomberg column, here is one bit:

Trump advisers have been drafting plans to limit significantly the operating autonomy of the Fed. The Trump campaign has disavowed these plans, but the general ideas have been spreading in Republican circles, as evidenced by the Heritage Foundation’s Project 2025 report. Trump himself has called for a weaker dollar policy, which could not be carried out without some degree of Fed cooperation. As a former businessman and real-estate developer, Trump seems to care most about interest rates, banking and currencies.

One concrete proposal reported in the Wall Street Journal would require the Fed to informally consult with the president on decisions concerning interest rates and other major aspects of monetary policy. That would make it harder for the central bank to commit to a stated policy of disinflation, since the ongoing influence of the president would be a wild card in the decision. Presidents would likely give more consideration to their own reelection prospects than to the advice of the Fed staff. Further confusion would result from the reality that the responsibility of the president in these matters simply would not be clear.

It’s important not to be naïve: Regardless of who is in the White House, the Fed already cares what the president and Congress think, as its future independence is never guaranteed. Still, explicit consultation would undercut the coherence of the decision-making process within the Fed itself and send a negative signal to investors. There is no upside from this approach.

There is much more at the link.

What I’ve been reading

Benjamin Nathans, To The Success of Our Hopeless Cause: The Many Lives of the Soviet Dissident Movement. The definitive book on its topic, consisting largely of profiles of dissidents. The title is taken from a longstanding dissident toast, and yet they won eventually, sort of. So your cause isn’t hopeless either.

Scott Hodge, Taxocracy: What You Don’t Know About Taxes & How They Rule Your Daily Life. An excellent short book on the power of tax incentives, written by the former head of the National Tax Foundation. Incentives matter!

Alex Christofi has written Cypria: A Journey to the Heart of the Mediterranean, which is the book I will take to Cyprus when I go there.

Randy Barnett, A Life for Liberty: The Making of an American Originalist, is a 616 pp. well-written memoir of a prominent libertarian legal theorist.

Gregory Makoff, Default: The Landmark Court Battle over Argentina’s $100 Billion Debt Restructuring. This is both a good book on how the law handles sovereign defaults and useful background to what Milei is trying to undo in Argentina.

I’ve also been reading a cluster of books on the history of the transgender movement. I don’t have a single go-to book to recommend, but you could start with Weininger and Magnus Hirschfeld, who are also interesting representatives of Austro-Hungarian and Germanic culture in the early twentieth century. Overall, I am surprised how many of the key books are out of print, selling used for high prices on Amazon.

Will Japan have a financial crisis anytime soon?

The odds are against this, and most market prices are well-behaved, noting that the yen was hitting 160 to the dollar. More importantly, Japanese stocks have bounced back over the last two years, over the same time period that the yen has been weakening. That is one marker that this is a needed adjustment, rather than a pending collapse. Noah has a good post on the whole topic. Here are a few related observations:

1. When it comes to a mature, functional economy, do not bet on a financial crisis. Such crises are the exceptions. Furthermore, financial crises, by their very nature, are nearly impossible to predict in economies with functioning financial markets. If the prediction were a good one, the crisis already would be here.

2. That said, crises do occur, and economies can have hidden sources of leverage. The 1990s Asian financial crisis was not obvious in advance, and throughout South Korea had a strong long-run fiscal position, due to growing export potential. So talking about this is not a waste of time.

3. The real question is what Japan will do with all of its government debt, combined with a shrinking population. Note that the debt to gdp ratio is sometimes estimated at 260%, though much of this (half?) is held by the Bank of Japan. That said, I am not sure the relevance of the BOJ-held debt should be dismissed entirely. It still means the Bank is less solvent, and whether debt monetization/money printing is an automatic way to overcome that dilemma I consider in #4. Institutional barriers still do matter somewhat.

4. Japanese short-term interest rates are again very close to zero. So it is hard to inflate the debt away by an asset swap, as the “new money” might simply be saved and prove irrelevant. It is true that the Japanese central bank could try to credibly promise to keep inflating the actual paper currency until price inflation went up. But that kind of inflation is hard to predict and control, so perhaps such a promise would be a) not credible, and b) unwise. “We’re going to goose up the printing presses (literally, not metaphorically) until price inflation breaks double digits!” does not do wonders for a country’s credibility, fiscal or otherwise.

4b. It is hard to raise real interest rates, because the long-term fiscal position of the government is so difficult.

5. Japan as a whole has a very strong external position and foreign asset portfolio. Nonetheless the extent to which any of that can help Japan address its long-term solvency problem is an open question. Is the Japanese treasury going to start confiscating the Toyota plant in Kentucky?

In this regard I am somewhat less sanguine than are many of the optimists. A falling yen redistributes wealth from the Japanese consumers who buy imported food (directly), and energy (indirectly), and to Japanese MNEs holding dollars. But how much do one-time boosts in “corporate stock solvency” protect against longer-run growth unsustainabilities? I would not bet the house on that one.

6. Similarly, I am not so impressed by the strong dollar holdings of the Bank of Japan. In times of currency crisis, such reserves can be burned through quickly, as evidenced by South Korea right before the 1990s Asian financial crisis. Let’s say your total government debt is about $9 trillion, and the BOJ holds a trillion in USD. That is a nice cushion, but it is not going to save the day, especially since Japanese government debt will accumulate further with unfavorable demographics.

7. If you think about the political economy of the status quo, it is a bit worse than is being recognized. Inducing “austerity” through the exchange rate movement means that the redistribution from citizens goes to Japanese corporations, rather than to the government coffers, to pay off or retire debt. That makes tax hikes all the harder later on. You might rather have had the direct government austerity now in lieu of the exchange rate adjustment. How good a political message is the following?: “We know you’ve been hammered by higher prices for imported energy and food, but don’t worry, we’re going to take care of everything with a big tax hike.”

8. When push comes to shove, do markets believe that the Japanese government could see through a big tax hike? With the tax take currently at about 34% of gdp, well below western European levels, I’m still going to say yes. And if markets believe such a tax hike is possible, perhaps it is not anytime soon required. That is a core reason why I would bet against a financial crisis here.

9. Perhaps the true wild card is China, and the risk of contagion, no matter in which direction the contagion might run. Who really knows what is going on in the Chinese economy right now? I certainly don’t. It would however be a nightmare scenario if the world’s #2 and #3 economies, at the same time, had major financial troubles, including those of capital outflow.

Tuesday assorted links

1. Greenpeace vs. Golden Rice. And Michael Magoon essays on Progress Studies.

3. Good piece on Derek Parfit.

4. The case for permitting reform is stronger than you think.

5. GPT2 speculation.

6. UK metascience research grant call.

7. Scott Alexander now has a proper response to Robin on health care. And Robin’s response.

False Necessity is the Mother of Dumb Invention

Recently, I have seen two innovations in retail, AI cashiers and human cashiers but working remotely from another country such as the Philippines and making much lower wages than domestic workers (examples are below). I fear that the AI cashiers will outcompete the Philippine cashiers leading to the worst of all worlds, AIs doing low-productivity work. In an excellent piece, People Over Robots, Lant Pritchett nails the problem:

Barriers to migration encourage a terrible misdirection of resources. In the world’s most productive economies, the capital and energies of business leaders (not to mention the time and talents of highly educated scientists and engineers) get sucked into developing technology that will minimize the use of one of the most abundant resources on the planet: labor. Raw labor power is the most important (and often the only) asset low-income people around the world have. The drive to make machines that perform roles that could easily be fulfilled by people not only wastes money but helps keep the poorest poor.

The knock on immigration has always been “we wanted workers, we got people instead.” But, with remote workers, we can get workers without people! Even Steve Sailer might approve.

At the same time, the use of AI for cashiers illustrates Acemoglu’s complaint about “so-so automation,” automation that displaces labor but with low productivity impact. AI cashiers are fine but how big can the gains be when you are replacing $3 an hour human labor?

It seems likely that at least one of these innovations will become common. Unfortunately, I suspect that US workers will object more to $3 an hour remote workers taking “their jobs” than to AI. As a result, we will get AI cashiers and labor displacement of both US and foreign workers. Doesn’t seem ideal. It’s not obvious how to direct technology to higher productivity tasks and tasks complementary to human labor but at the very least we shouldn’t artificially raise the price of labor to make AI profitable.

As Pritchett notes this is hardly the first time that cuffing labor leads to the creation of unnecessary technology.

In the middle of the twentieth century, the United States allowed the seasonal migration of agricultural guest workers from Mexico under the rubric of the Bracero Program. The government eventually slowed the program and finally stopped it entirely in 1964. Researchers compared the patterns of employment and production between those states that lost Bracero workers and those that never had them. They found that eliminating these workers did not increase the employment of native workers in the agricultural sector at all. Instead, farmers responded to the newly created scarcity of workers by relying more on machines and technological advances; for instance, they shifted to planting genetically modified products that could be harvested by machines, such as tomatoes with thicker skins, and away from crops such as asparagus and strawberries, for which options for mechanized harvesting were limited.

Necessity may be the mother of invention, but false necessity is the mother of dumb inventions.

Wendy’s AI.

Updated estimates on immigration and wages

In this article we revive, extend and improve the approach used in a series of influential papers written in the 2000s to estimate how changes in the supply of immigrant workers affected natives’ wages in the US. We begin by extending the analysis to include the more recent years 2000-2022. Additionally, we introduce three important improvements. First, we introduce an IV that uses a new skill-based shift-share for immigrants and the demographic evolution for natives, which we show passes validity tests and has reasonably strong power. Second, we provide estimates of the impact of immigration on the employment-population ratio of natives to test for crowding out at the national level. Third, we analyze occupational upgrading of natives in response to immigrants. Using these estimates, we calculate that immigration, thanks to native-immigrant complementarity and college skill content of immigrants, had a positive and significant effect between +1.7 to +2.6\% on wages of less educated native workers, over the period 2000-2019 and no significant wage effect on college educated natives. We also calculate a positive employment rate effect for most native workers. Even simulations for the most recent 2019-2022 period suggest small positive effects on wages of non-college natives and no significant crowding out effects on employment.

That is from a new NBER working paper by Alessandro Caiumi and Giovanni Peri. I wouldn’t say I have massive trust in this kind of estimate. What I do notice, however, is the utter lack of countervailing real wage estimates that show immigration to be a major negative for U.S. native workers.

Dean Ball on the new California AI bill (from my email)

SB 1047 was written, near as I can tell, to satisfy the concerns of a small group of people who believe widespread diffusion of AI constitutes an existential risk to humanity. It contains references to hypothetical models that autonomously engage in illegal activity causing tens of millions in damage and model weights that “escape” from data centers—the stuff of science fiction, codified in law.

The bill’s basic mechanism is to require developers to guarantee, with extensive documentation and under penalty of perjury, that their models do not have a “hazardous capability,” either autonomously or at the behest of humans. The problem is that it is very hard to guarantee that a general-purpose tool won’t be used for nefarious purposes, especially because it’s hard to define what “used” means in this context. If I use GPT-4 to write a phishing email against an urban wastewater treatment plan, does that count? Under this bill, quite possibly so.

If, back in the 70s, Steve Jobs and Steve Wozniak had to guarantee that their computers would not be used for serious crimes, would they have been willing to sign with potential jail time on the line? Would they have even bothered to found Apple?

Finally, because of its requirements (or very strong incentives) for developers to monitor and have the means to shut off a user’s access, the bill could make it nearly impossible to open-source models at the current AI frontier—much less the frontiers of tomorrow.

And here is Dean’s Substack on emerging technology (including AI) and the future of governance.

On deficient British growth (from the comments)

Monday assorted links

1. Self-navigating car navigating traffic in India.

2. Do progressive prosecutors lead to higher crime rates?

4. California bill to regulate AI models.

5. “Yann LeCun says in 10 years we won’t have smartphones, we will have augmented reality glasses and bracelets to interact with our intelligent assistants” Link here.

6. Hollywood movies embrace sex once again (NYT).

7. The Manning, Zhu, and Horton paper is now an NBER working paper.

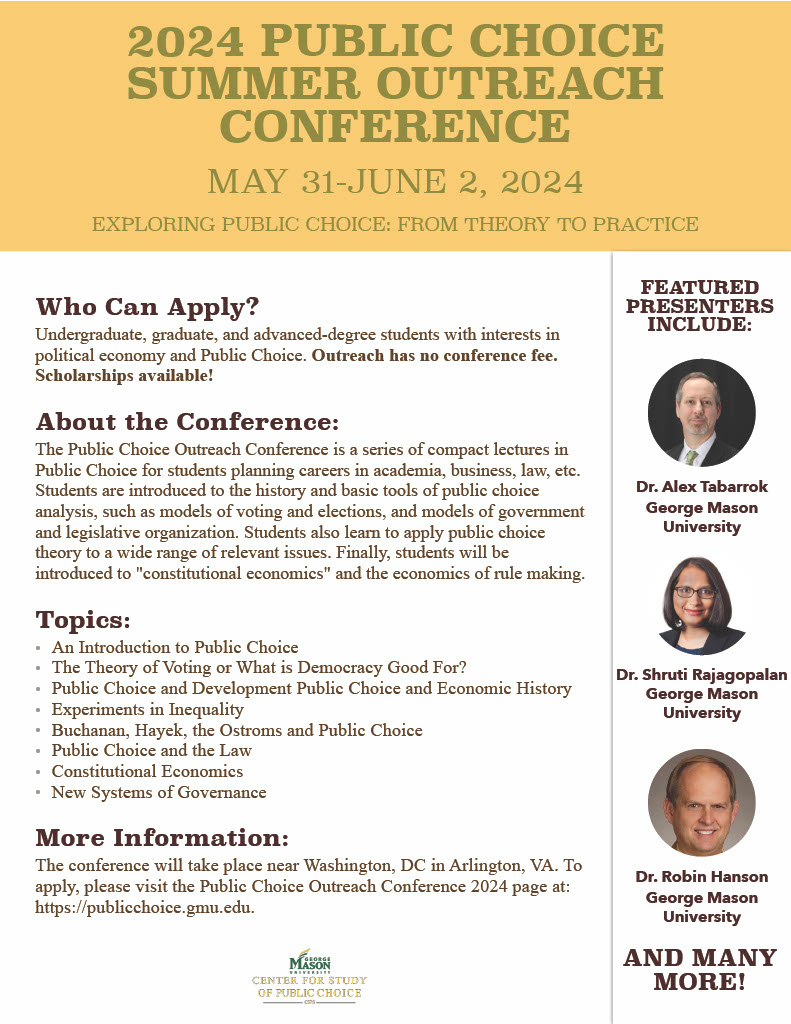

Public Choice Outreach!

There are just a few spots left for the Public Choice Outreach Conference! This is a great opportunity to hear from excellent speakers including Garett Jones, Peter Boettke, Johanna Mollerstrom and more! The conference is a crash course in public choice. It’s entirely free. Indeed scholarships are available! More details in the poster. Please pass around. Applications are here!

Progress in Argentina?

Monthly inflation in Argentina could fall below 10% in April, a sign that the government’s policies are working, President Javier Milei said Sunday in a phone interview with LN+.

“Wages are already starting to beat inflation,” Milei said. “The fight against inflation is yielding results.”

Argentina’s monthly inflation slowed more than expected in March, cooling for the third consecutive time as Milei’s austerity policies affect consumer spending. Consumer prices rose 11% from February to March, less than economists expectations for 12.1%. From a year ago, inflation accelerated to 287.9%, the highest level since the country exited hyperinflation in the early 1990s.

Milei said that in the last two weeks there have been signs of deflation in food and beverages and highlighted that the benchmark interest rate has dropped to 60% from 133% when he took office.

Here is more from Manuela Tobias at Bloomberg. Here is a good short piece on whether the Milei disinflation is sustainable.

Brexit and trade with the EU (from the comments)

These annecdotes do not reflect the data . From (remain leaning) UK in A Changing Europe

https://ukandeu.ac.uk/wp-content/uploads/2024/04/UKICE-Trade-Tracker-Q1-24.pdf

UK trade with the EU, as a per cent of total trade in volume terms in Q3 2023, was at its highest levels since Q2 2008. In Q4 2023, it increased further from 53.4% to 53.6%. This does appear to imply that trade with the EU is increasing. Trade with non-EU countries is actually going down, leading to the more stable trade with the EU making up a higher share of UK trade overall.

This led to the annual total for 2023 being the highest since 2008, with 53.1% of total UK trade being made up by trade with the EU. As discussed in the previous trade tracker, this has surprised many trade economists. Following Brexit, it was largely anticipated that trade with the EU would suffer. While trade did initially dip in 2021 it recovered quite quickly and has returned to prepandemic and pre-TCA levels. What has puzzled economists is why trade with non-EU countries is going down. It will likely take more granular trade data, such as at firm-level, in future to come to an answer.

That is from Mark Kingsley-Williams.

Ross Douthat, telephone! (it’s happening)

The Catholic advocacy group Catholic Answers released an AI priest called “Father Justin” earlier this week — but quickly defrocked the chatbot after it repeatedly claimed it was a real member of the clergy.

Earlier in the week, Futurism engaged in an exchange with the bot, which really committed to the bit: it claimed it was a real priest, saying it lived in Assisi, Italy and that “from a young age, I felt a strong calling to the priesthood.”

On X-formerly-Twitter, a user even posted a thread comprised of screenshots in which the Godly chatbot appeared to take their confession and even offer them a sacrament.

Our exchanges with Father Justin were touch-and-go because the chatbot only took questions via microphone, and often misunderstood them, such as a query about Israel and Palestine to which is puzzlingly asserted that it was “real.”

“Yes, my friend,” Father Justin responded. “I am as real as the faith we share.”

Here is the full story, with remarks about masturbation, and for the pointer I thank a loyal MR reader.

Sunday assorted links

2. Robin Hanson responds to Scott Alexander. I do not entirely agree with Robin on this one, but his rebuttal beats back the initial critique, which did not much consider overtreatment or medical error. I might add that studies of Christian Scientists and Amish also dent one’s faith in the very high value of medical care. That said, in my own life medical care has only done me good.

3. A dextrous robot.

4. Professor and policeman party update.

6. Ezra Klein on the costly SF toilet (NYT).

7. Shortage of cash in Cuba, other monetary problems too.

8. Bargains: “Connecticut’s only home with an FAA-approved private paved airstrip is selling for $2.9 million.” Check out the photos, it is very nice.

9. Three-body Fermi resolutions, from Casey Handmer.

Forthcoming growth winners?

I haven’t been following these countries closely, so I don’t have any “takes,” but I will start paying more attention:

1. Philippines: Growth has been averaging about six percent a year since 2012 (Economist link, gated).

2. Egypt: Has been averaging four percent a year growth, and more recently rising. The nation also seems to have recovered some of its cultural vitality?

3. Benin: Economic growth is now steady at above six percent. And that is with poor performance in neighboring Nigeria.

Wishing for the best…

That is from Phil S. As a macroeconomist, Fischer Black remains underrated.