View:

June 08, 2024

June 07, 2024

Preview: Due June 20 - U.S. May Housing Starts and Permits - Neutral month within a slowing trend

June 7, 2024 6:48 PM UTC

We expect little change in May housing starts, where we expect a rise of 0.7% to 1370k, or permits, which we see unchanged at 1440k. This is likely to be a pause before renewed slowing.

Mexico CPI Review: Some Pressure in Services

June 7, 2024 5:10 PM UTC

INEGI reported a 0.2% CPI decrease in May, with annual CPI stable at 4.7%. Electricity prices dropped, contributing to the decline. Core CPI rose 0.2%, while Non-Core fell 1.3%. Persistent Services CPI and food price shocks may sustain inflation. Peso volatility could also pressure inflation, likely

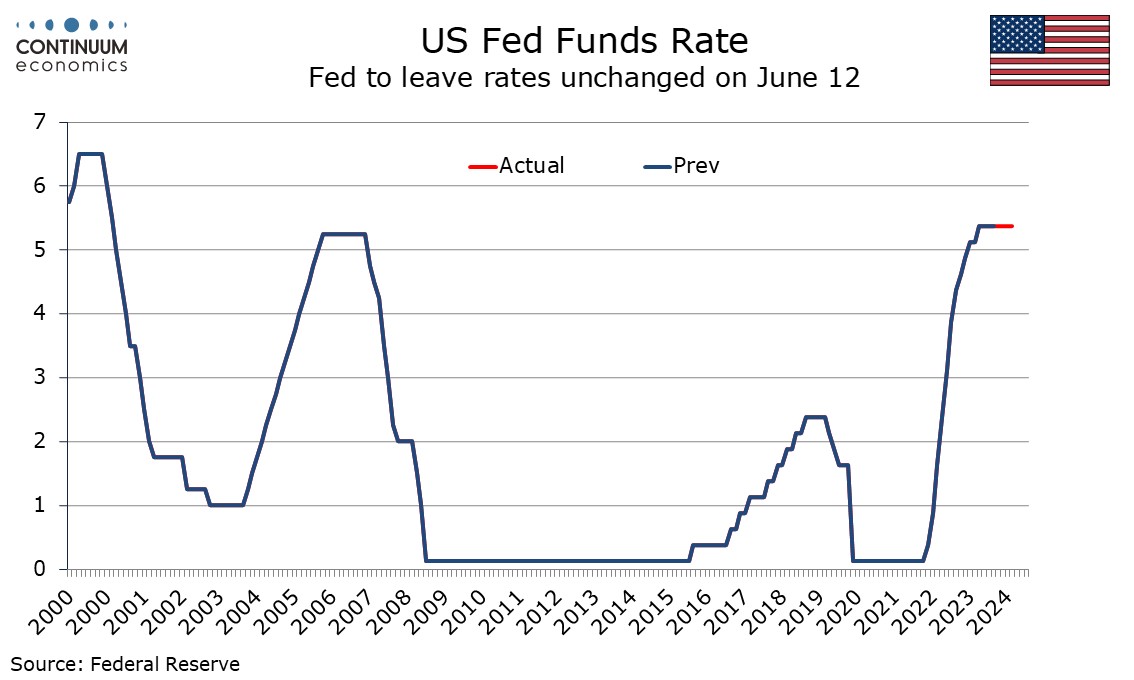

FOMC Preview For June 12: Hawkish Dots, Flexible Press Conference

June 7, 2024 3:29 PM UTC

Bottom Line: The FOMC meets on June 12 and looks sure to leave the target range unchanged at 5.25%-5.50%. The tone of the statement may be influenced by the May CPI that will be released on the morning of the decision, but even if CPI surprises on the downside is unlikely to give any hints easing is

Canada May Employment - Unemployment rising but wages holding up

June 7, 2024 1:34 PM UTC

Canada’s May employment was a mixed bag with a near consensus 26.7k increase in employment and a rise in unemployment o 6.2% from 6.1% giving support to the recent BoC decision to ease rates. However an unexpected acceleration in wage growth does suggest persistent inflationary risk.

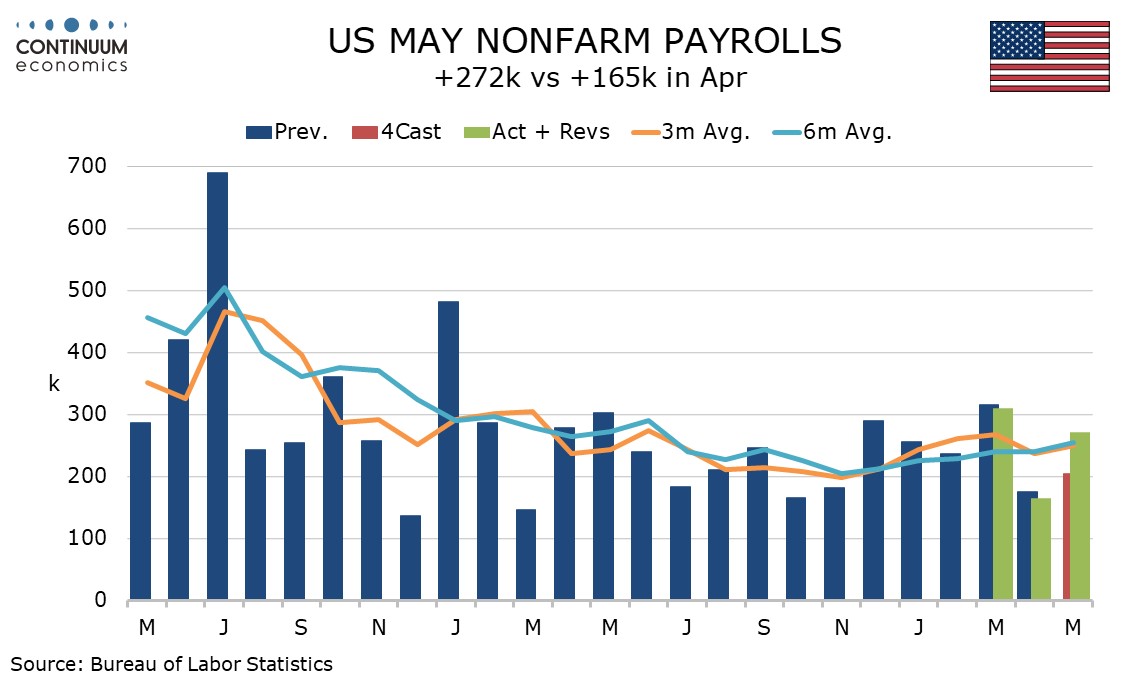

U.S. May Employment - Trends still firm in payrolls and average hourly earnings

June 7, 2024 1:05 PM UTC

May’s non-farm payroll is clearly stronger than expected with a 272k increase and only 15k in negative back month revisions, with private payrolls up by 229k. Average hourly earnings are also on the firm side of consensus with a rise of 0.4%. Despite unemployment edging up to 4.0% from 3.9% with w

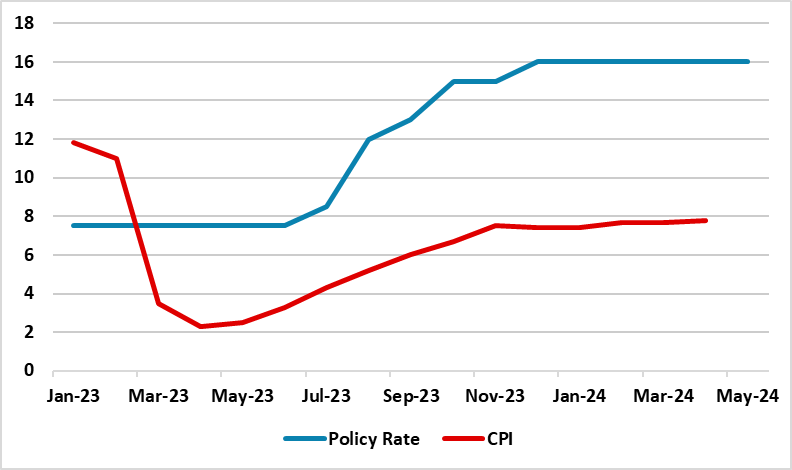

CBR Kept the Key Rate Stable at 16% despite Increasing Inflation

June 7, 2024 12:57 PM UTC

Bottom Line: Central Bank of Russia (CBR) announced on June 7 that it decided to keep the policy rate unchanged at 16% for the fourth meeting in a row, but signalled that a rate hike is possible in the near term to tame the stubborn price pressures stemming from high military spending, tight labour

China Excess Production: Exports Going Cheap?

June 7, 2024 8:45 AM UTC

China excess of production over domestic demand is causing disinflation pressures in China, but also leading to a fall in export prices as China companies seek buyers for production. Though this is a helpful factor to the global inflation debate, it is causing trade tensions with the U.S. and EU o