Top Stories

De Beers Looks to Long-Term Market Recovery Amid Drop in Sales

Fourth cycle total down 21% year on year and 15% from April.

Five Market Trends to Watch Out for at JCK Las Vegas

Will the show signal a turnaround in US diamond demand?

Most Popular

Jewelry and Watch Trends: Rapaport Magazine Highlights

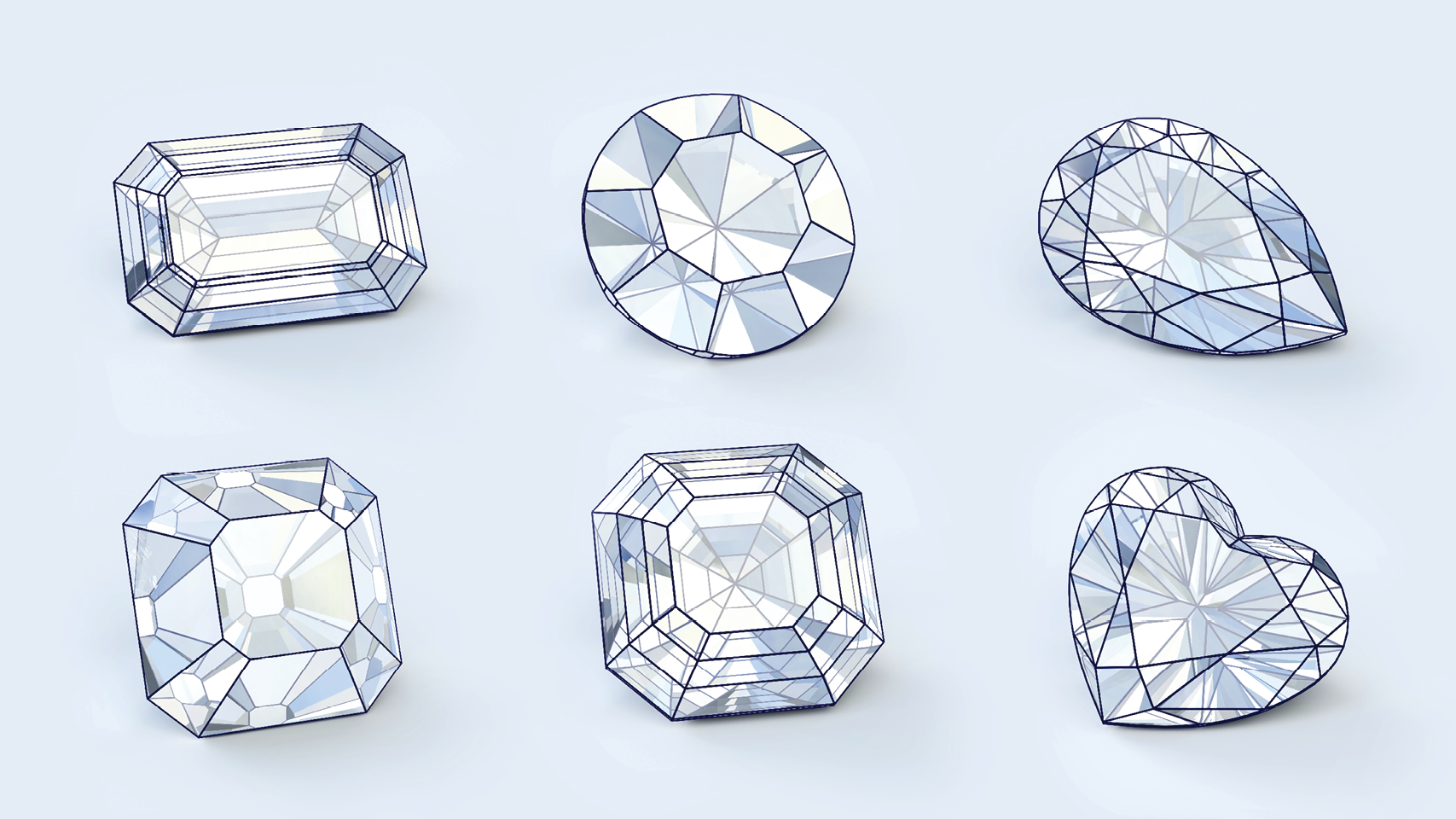

Rapaport Magazine Checks Out Trending Fancy Cuts

Consumers are exploring diamond shapes beyond the classic round brilliant, offering designers broader opportunities.

Industry

April 3, 2024

Geoff Hess of Sotheby’s Talks Vintage Timepieces

Face to Face: The auction house’s head of watches for the Americas reflects on the latest trends and connoisseurs’ most coveted models.

Watches

April 2, 2024

Today’s Signet Rings Are Moving Away from Monograms

Seals of approval: Personalized and one-of-a-kind styles are leading the pack, with designs that look to the future rather than connecting to the past.

Jewelry

April 2, 2024

Rapaport

Market Data

Diamonds

Metals

Currencies

Equities

Market Comment - May. 23, 2024

US suppliers cautiously optimistic for Las Vegas shows, as jewelers have reduced inventories.

Indian market slow as dealers reduce buying.

Prices of round, 1 ct., D-J, IF-VS1 diamonds continue to drop. SI2 improving. Fancy shapes weak.

Reuters reports US govt. “has cooled on enforcing traceability” regarding Russian sanctions, with Signet lobbying against G7 Belgium solution.

Plans for sale of De Beers creating uncertainty.

Okavango May rough sales +84% YOY to $104M amid price drop in 3 gr. and larger sizes.

FY 2024 sales at Richemont jewelry maisons +6% to $15.5B.

De Beers and Signet to collaborate on natural-diamond marketing.

Israel bourse elects Nissim Zuaretz as president.