Tim Webb

Centrica, owner of British Gas, may not be the most popular company among consumers, particularly when fuel bills land for this winter. But the freezing weather – and corresponding higher gas consumption – will be good for the company's bottom line and for investors. It will also get households thinking more seriously about energy efficiency and insulation, which will also play straight into Centrica's hands. Under the government's "green deal", energy suppliers will meet the upfront cost of insulation in return for an annual charge. British Gas, targeting big profits from providing such home services, will be the first company to trial this in the coming year, and the government is expected to use the results to shape the green deal, no doubt to the benefit of Centrica (now at 331.6p).

Terry Macalister

Frank Chapman, the chief executive of BG Group, said in 2010 that he was not an "alien". But anyone who can convince a highly successful senior executive that they should swap an office in Rio de Janeiro for one in Reading must be superhuman. Fabio de Oliveira Barbosa, previously a Brazilian national treasury secretary as well as chief finance officer at the successful mining company Vale, brings political and financial clout. Good news for BG, (£12.96), which already has a winning position in Brazil – the ultimate location for deep-water oil reserves. BG is also well placed in the booming global liquefied natural gas market.

Richard Wachman

Compass, the world's biggest contract caterer, has had a good recession under its chief executive, Richard Cousins, serving up £1bn of operating profit last year. The shares (now 581p) have demonstrated good defensive value as the company has expanded its support services business, which spans office cleaning and reception. But catering is still the mainstay (customers include schools and government departments) and there is plenty of scope for overseas expansion. The company will be debt free by 2013, when it will have ample loose change to spend on acquisitions or on returning surplus cash to shareholders via special dividends or share buybacks.

Zoe Wood

Store group Dixons had a rollercoaster ride during the recession, but the former Tesco high-flier John Browett has been plugging away for three years now and his turnaround seems to be gaining traction. He has refurbished stores and improved customer service and in December launched a new upmarket brand, Black, to compete with slick retail environments such as the Apple Store. Now it is the turn of the group's rivals to look shaky: Comet is in trouble, while the new entrant Best Buy has yet to make a splash with UK consumers. At 22.92p, Dixons' shares are cheap – having shed 30% in 2010 – and although the impact of the VAT rise should not be discounted, surely the only way is up.

Simon Bowers

Shares in HMV Group have slumped 27% to 32p since the owner of Waterstone's and HMV said in December that "uncertain consumer outlook" in the peak trading season had forced it to cut its dividend. Fearful of the impact of heavy snow, the market is pricing in a potential collapse. A profits warning may not be far off but the sell-off seems overdone. Core categories – DVD and music sales – are in decline and attempts both to diversify and to compete online with Play.com and Amazon have had only limited success. This is a risky stock, facing multiple structural issues and considerable fixed costs. But – snow aside – the management has seen challenges coming for some time. There remains costs flexibility and strong cash generation. The Russian retail tycoon Alexander Mamut has built a stake of 5% in recent months.

Jill Treanor

Bob Diamond takes the helm at Barclays (261.65p) at the start of the year and as the owner of 9.9m shares he must have more interest in the share price than many chief executives. Tipping any bank in 2011 is risky: regulators are demanding banks cut their dividends – and bonuses – to bolster their capital base, while the coalition's banking commission is considering whether banks should be broken up to reduce risk and bolster competition. Breaking up Barclays is precisely what the Liberal Democrats want to do. While Diamond will fight to keep the business together, he is also the only executive capable of taming the investment bank he created.

Graeme Wearden

Promethean World, a maker of hi-tech whiteboards for classrooms, has tested the City's patience in 2010. Its shares have slumped to 65.75p since floating at £2 in March, partly due to a shock fall in sales in November. But 2011 could see the company shed its dunce's cap. Although education budgets are suffering in the global age of austerity, Promethean hopes many schools have just postponed their spending rather than permanently lost faith in new technology. If that's true, and the company also wins back some credibility, then Goldman Sachs' target of 83p looks achievable. But widows and orphans should still beware.

Nick Fletcher

Real Good Food Company, 24p, could prove tasty for investors this year. The Aim-listed company's bakery ingredients business is hitting new records, and its cakes division should also continue to do well – the company has a very strong relationship with Waitrose and supplies 80% of its products to the group, including the Seriously range. Marks & Spencer is another key customer. The company also owns Napier Brown, the largest independent non-refining distributor of sugar in Europe, and after a tough few years, prospects are looking sweeter as a shortage leads to higher prices.

Julia Finch

This could be madness but take a look around you on the high street: the Superdry logo is the label du jour on both 14-year-olds and forty-somethings. SuperGroup shares floated in 2010 and soared from 500p to more than £16. A warning on cotton prices hitting margins from the founder and now chief executive, Julian Dunkerton, saw the price recoil to such an extent the company is now dubbed Superdroop. But its preppie-look fashion is still spot on, there is no sign so far of label fatigue and the business has huge international potential. Despite the recent setback, the shares are still expensive at £12.97 but Goldman Sachs has a price target of £21. Worth a punt for the brave.

Julia Kollewe

Hiscox, a Lloyd's of London insurer, looks to be in a better position than some of its competitors. Analysts at Execution Noble note: "We expect greater earnings resilience versus peers as Lloyd's pricing softens. While the pricing outlook for Lloyd's business looks to be flat to -5% in 2011, Hiscox's franchise focuses on shorter tail and reinsurance lines where margins remain the most attractive." The Bermuda-based company, which also specialises in insuring against kidnap and covering fine art, is expected to deliver a 15% return on equity in 2011. Hiscox (381.4p) has just announced plans for a share buyback in January and February.

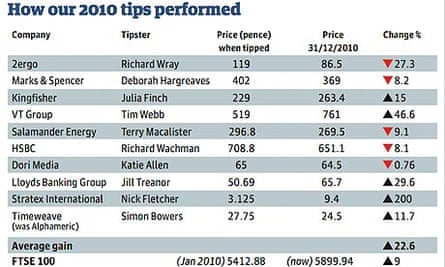

Last year's winners

Despite Europe's sovereign debt crisis, turmoil in the bond markets unsettling investors, government austerity measures and BP's slump following the Gulf of Mexico disaster, equities still managed to move sharply higher last year.

The FTSE 100, having fallen as low as 4805 in July, recovered strongly in the second half of the year to finish 9% higher at 5899. Commodity companies provided much of the gains, boosted by continuing strong demand from China even though that country seemed determined to calm down its runaway economy.

So it is no surprise that one of the best performers among the Guardian's share tips last year was a mining group, albeit a somewhat smaller one than the likes of BHP Billiton and Rio Tinto.

Stratex International is successfully exploring for gold in Ethiopia and Turkey, and during the year it continued to develop its prospects and bring in partners to help spread the costs. Its potential has only been enhanced by the record gold price, and its shares have tripled during the year.

Another winner was VT Group, which held out for a good price before finally agreeing a cash and share take over by Babcock International. Also doing well were Kingfisher – perhaps surprisingly given the worries about the retail environment and consumer confidence – and Lloyds Banking Group, majority-owned by the taxpayer now, of course, but still managing to rise above the continuing financial crisis to record a 29% rise.

Sadly there were a number of disappointments, notably mobile marketing group 2ergo which should have been in the right place at the right time but somehow was not. An impairment charge against an investment in SMS specialist Broca did not help matters.

Despite this our average gain was a market-beating 22%. Nick Fletcher

Comments (…)

Sign in or create your Guardian account to join the discussion